Imagine this: you're rushing through your daily grind, and suddenly, you need to pay a bill or transfer some funds. Sounds stressful, right? But not anymore! Metro Payment Online is here to transform the way you handle your financial transactions. With just a few clicks, you can manage everything from utility bills to online shopping—all in one place. So, buckle up and dive into this comprehensive guide that’ll help you navigate the world of metro payment online like a pro.

Let's face it, we live in an era where time is money, and convenience is king. Traditional banking methods are slowly becoming a thing of the past. People are now gravitating towards faster, more efficient ways to manage their finances. Enter metro payment online—a game-changer in the digital finance space. Whether you're a tech-savvy millennial or someone new to online transactions, this platform has something for everyone.

Now, you might be wondering, "What exactly is metro payment online?" Don’t worry, we’ve got you covered. In this article, we’ll break it down for you step by step. From its benefits to potential challenges, we’ll explore everything you need to know about this revolutionary system. So, let’s jump right in and discover why metro payment online is the future of digital transactions!

Read also:Bollyflix Site Your Ultimate Destination For Bollywood Entertainment

What is Metro Payment Online?

First things first, metro payment online refers to a digital platform designed to facilitate seamless online transactions. It’s like having a personal financial assistant at your fingertips. Whether you want to pay your electricity bill, top up your mobile wallet, or even buy groceries, this system makes it all possible with minimal effort. Think of it as the Swiss Army knife of online payments—compact, versatile, and super convenient.

How Does Metro Payment Online Work?

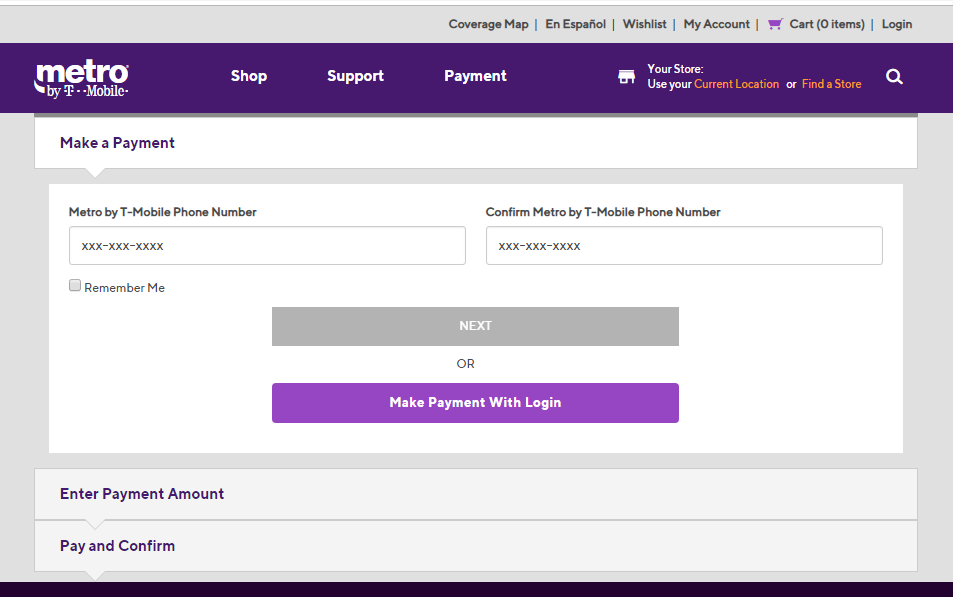

The process is surprisingly simple. All you need is a stable internet connection and a valid account with the metro payment platform. Once you’ve signed up, you can start exploring a wide range of services. The platform usually integrates with multiple banks and service providers, ensuring that you have access to everything you need in one place. Here’s a quick rundown of how it works:

- Sign up for an account using your email or phone number.

- Verify your identity through a secure authentication process.

- Link your bank account or add funds to your digital wallet.

- Choose the service you want to pay for and confirm the transaction.

Voilà! Your payment is processed instantly, and you’re good to go. No more standing in long queues or dealing with paperwork. It’s all about speed and efficiency.

Benefits of Using Metro Payment Online

So, why should you consider switching to metro payment online? The answer lies in its numerous advantages. Let’s take a closer look at what makes this platform so appealing:

1. Convenience

Let’s be honest—no one likes wasting time on mundane tasks like paying bills. With metro payment online, you can handle all your financial obligations from the comfort of your home. Whether you’re lounging on your couch or sipping coffee at your favorite café, you can complete transactions with ease. It’s like having a personal assistant who’s always ready to help.

2. Speed and Efficiency

Traditional banking methods often involve waiting times and bureaucratic hurdles. Metro payment online eliminates all that hassle. Transactions are processed almost instantly, saving you valuable time. Need to pay a bill before the deadline? No problem! With this platform, you can get things done in a jiffy.

Read also:Clix Haircut 2025 The Ultimate Guide To The Trendiest Hairstyles Of The Year

3. Security

Security is a top priority for any digital platform, and metro payment online is no exception. These systems are equipped with state-of-the-art encryption technologies to protect your sensitive information. From two-factor authentication to secure payment gateways, every step is taken to ensure that your data remains safe and secure.

4. Cost-Effective

Did you know that using metro payment online can save you money? Many platforms offer zero transaction fees or reduced charges compared to traditional banking. Plus, you can avoid late payment penalties by scheduling automatic payments. It’s a win-win situation for your wallet!

Common Uses of Metro Payment Online

Now that we’ve covered the basics, let’s explore some of the most common use cases for metro payment online:

1. Utility Bill Payments

Tired of juggling multiple bills every month? Metro payment online lets you pay for electricity, water, gas, and internet services in one go. You can even set up automatic payments to ensure you never miss a deadline. Say goodbye to late fees and hello to peace of mind!

2. Mobile Recharges

Running low on mobile credit? No worries! Metro payment platforms allow you to recharge your phone instantly. Whether you’re buying prepaid minutes or adding data bundles, it’s all a breeze. Plus, many platforms offer exclusive deals and discounts for mobile recharges.

3. Online Shopping

Love shopping online but hate the hassle of entering your card details every time? Metro payment online makes the checkout process smoother and faster. Many e-commerce websites now accept payments through these platforms, ensuring a seamless shopping experience.

4. Money Transfers

Need to send money to a friend or family member? Metro payment online has got your back. You can transfer funds instantly without any hassle. Whether it’s a small amount or a large sum, the process is secure and reliable.

Challenges and Risks

While metro payment online offers countless benefits, it’s not without its challenges. Let’s take a moment to discuss some of the potential risks:

1. Internet Connectivity Issues

Since these platforms rely on a stable internet connection, any disruption can affect your transactions. Make sure you have a reliable Wi-Fi or mobile data plan to avoid any inconvenience.

2. Cybersecurity Threats

As with any digital platform, there’s always a risk of cyberattacks. However, most metro payment systems have robust security measures in place to mitigate these threats. Still, it’s essential to stay vigilant and follow best practices, such as creating strong passwords and enabling two-factor authentication.

3. Limited Access in Rural Areas

Unfortunately, not everyone has access to high-speed internet, especially in remote or rural areas. This can limit the adoption of metro payment online in certain regions. Governments and private companies are working to bridge this gap, but it’s a challenge that still needs addressing.

How to Choose the Right Metro Payment Platform

With so many options available, choosing the right metro payment platform can be overwhelming. Here are a few factors to consider:

1. Security Features

Always opt for platforms that prioritize security. Look for features like two-factor authentication, end-to-end encryption, and secure payment gateways.

2. User Interface

A user-friendly interface can make all the difference. Choose a platform that’s easy to navigate, even for those who aren’t tech-savvy.

3. Customer Support

Reliable customer support is crucial in case you encounter any issues. Ensure the platform offers multiple channels for assistance, such as live chat, email, or phone support.

Future Trends in Metro Payment Online

The world of digital payments is constantly evolving, and metro payment online is no exception. Here are a few trends to watch out for:

1. Integration with Blockchain Technology

Blockchain is set to revolutionize the way we handle transactions. Many metro payment platforms are exploring its potential to enhance security and transparency.

2. AI-Powered Chatbots

Artificial intelligence is being used to improve customer support through chatbots. These virtual assistants can handle inquiries 24/7, providing instant solutions to common issues.

3. Biometric Authentication

Biometric authentication, such as fingerprint or facial recognition, is becoming increasingly popular. It adds an extra layer of security while making the login process more convenient.

Data and Statistics

According to recent studies, the global digital payment market is expected to reach $10.5 trillion by 2025. This growth is driven by increasing internet penetration, rising smartphone usage, and growing consumer preference for contactless payments. In fact, a survey conducted by Statista revealed that 65% of consumers in urban areas prefer using digital payment methods over traditional ones.

Conclusion

In conclusion, metro payment online is more than just a convenient way to handle transactions—it’s a necessity in today’s fast-paced world. From paying bills to transferring money, this platform offers a wide range of services that cater to your financial needs. While there are some challenges to consider, the benefits far outweigh the drawbacks.

So, what are you waiting for? Take the plunge and embrace the future of digital transactions. Share this article with your friends and family, and let’s spread the word about the wonders of metro payment online. Who knows, you might just inspire someone to make the switch!

Table of Contents

How Does Metro Payment Online Work?

Benefits of Using Metro Payment Online

Common Uses of Metro Payment Online

How to Choose the Right Metro Payment Platform

Future Trends in Metro Payment Online